Statistics on automatic exchange of banking information and the right to hold authorities (and banks) to account - Tax Justice Network

OECD Tax on Twitter: "🗺️🔍 Browse the status of commitments for the automatic exchange of information (& more!) with our interactive map ➡️ https://t.co/hKN02uYcGy #AEOI #dataviz #tax https://t.co/zWGuyHgWaE" / Twitter

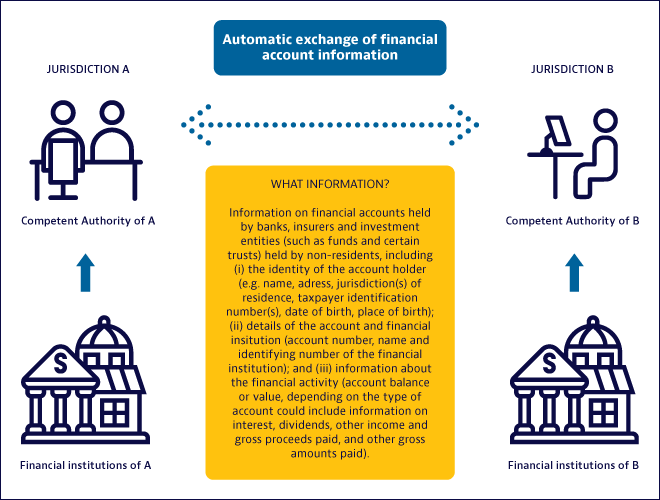

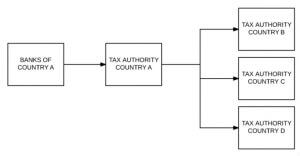

ARRANGEMENT BETWEEN THE COMPETENT AUTHORITY OF THE UNITED STATES OF AMERICA AND THE COMPETENT AUTHORITY OF THE REPUBLIC OF AUSTR

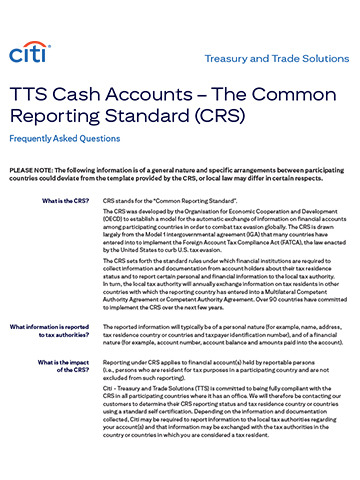

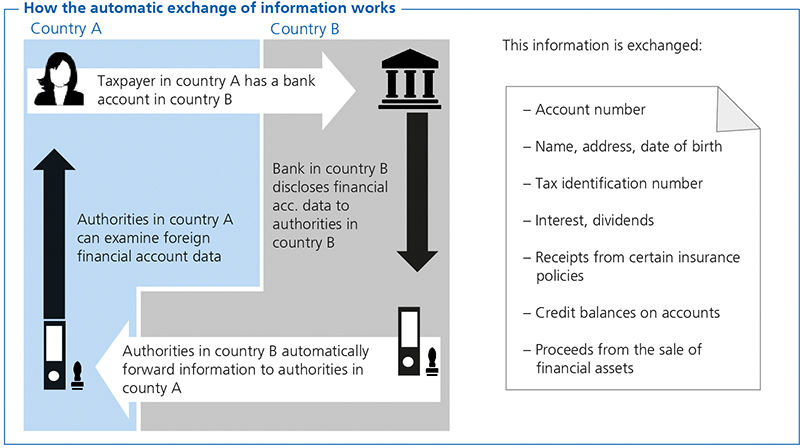

PDF) Automatic Exchange of Information as the new global standard: the end of (offshore tax evasion) history? | Markus Meinzer - Academia.edu

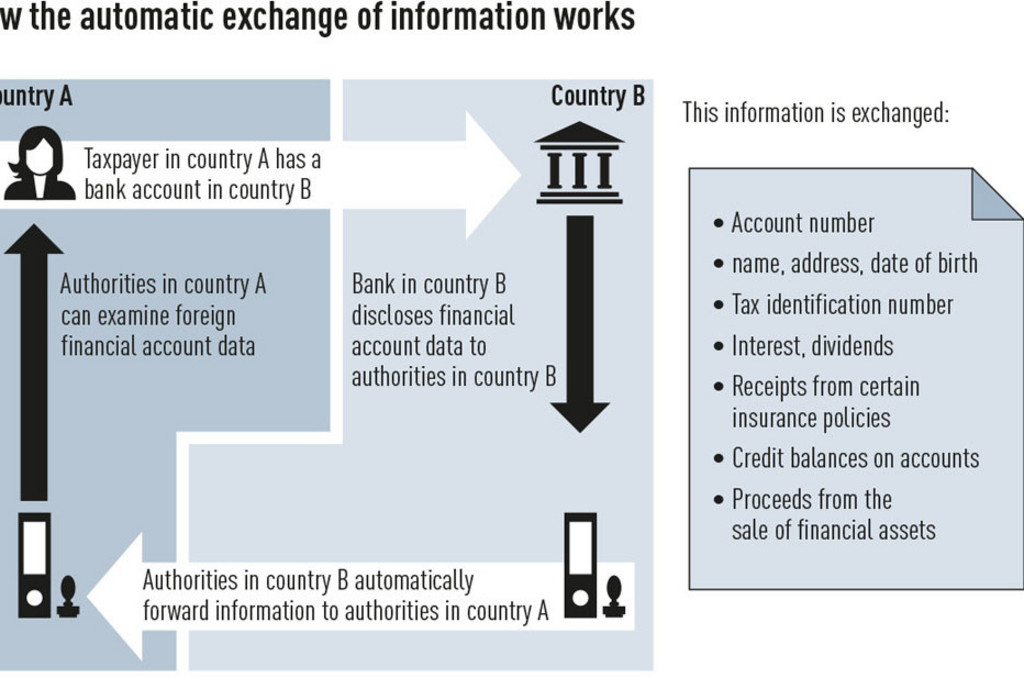

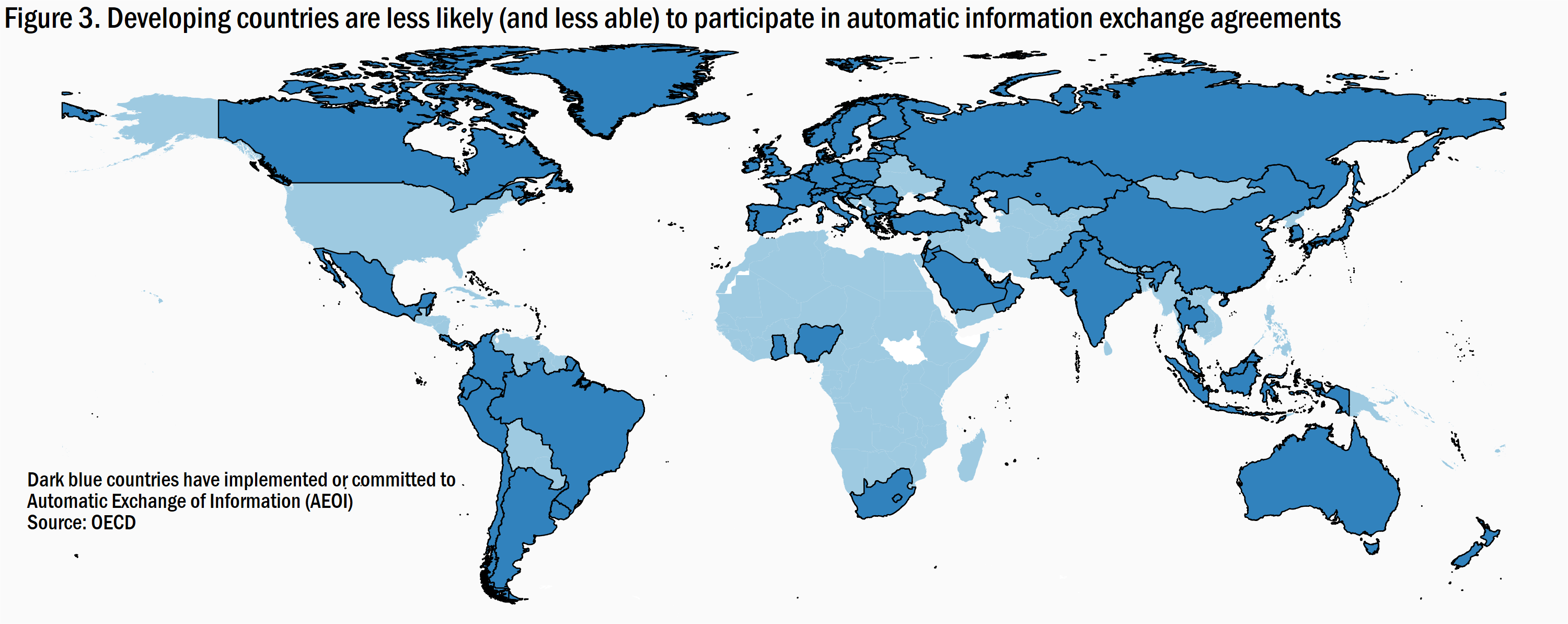

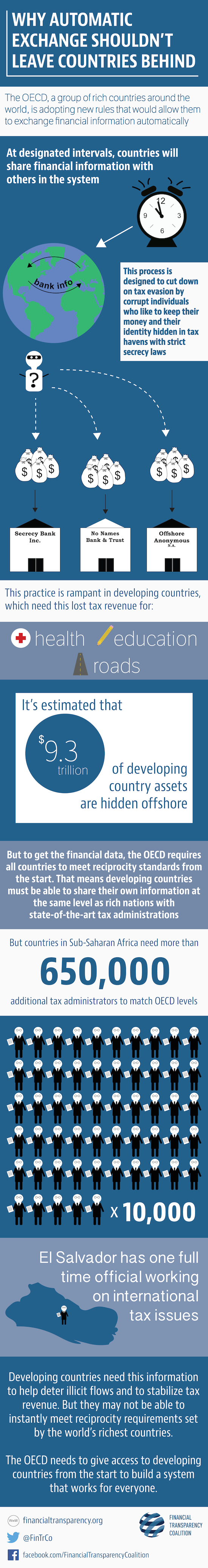

INFOGRAPHIC: Automatic Exchange of Information Shouldn't Leave Countries Behind - Financial Transparency Coalition

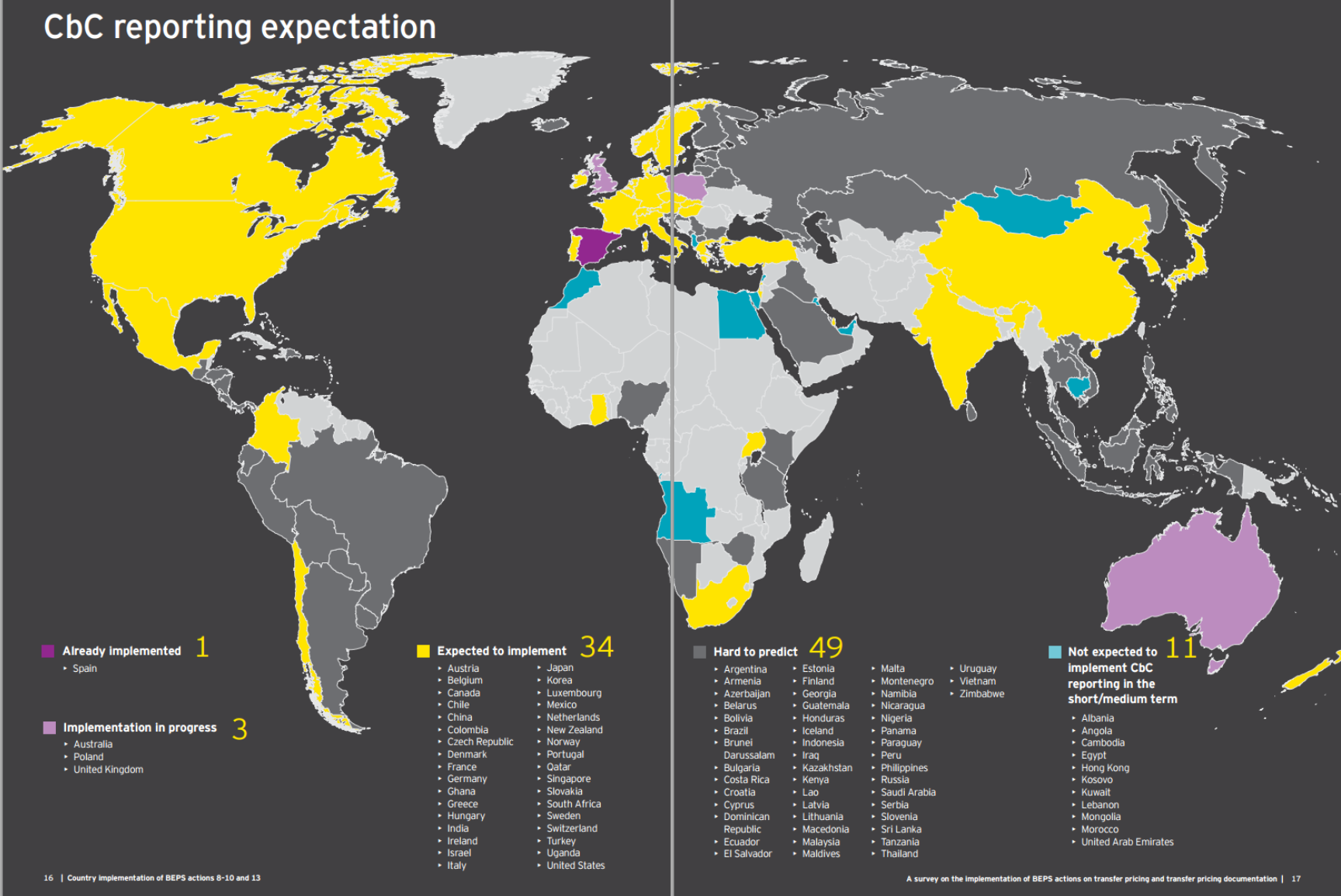

61 countries have now signed up for automatic exchange of tax information | International Tax Review